You might have come across news articles suggesting that renting is currently a better choice than owning a home. However, it’s important to understand the rationale behind these statements before allowing them to influence your choices.

Often, such reports make assumptions that do not align with the reality of an average household. For example, according to the methodology of one of these reports, renting is financially wiser as it provides the chance to invest money elsewhere. The assumption made is that renters utilize the money they would have spent on costs tied to buying a home and invest it in a portfolio.

But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:

“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”

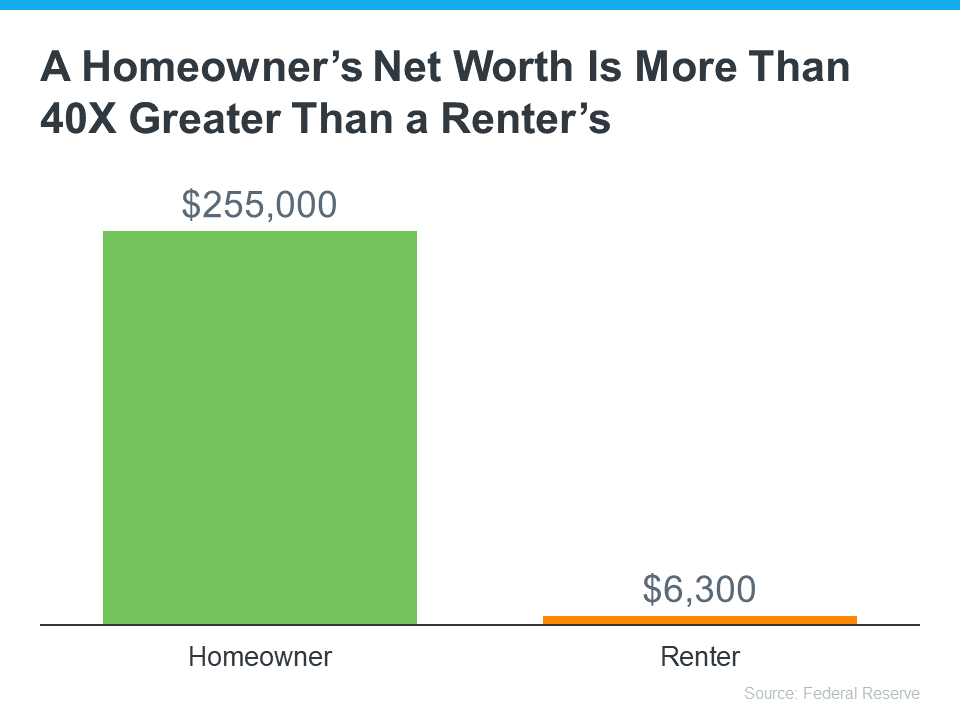

One of the reasons why owning a home is deemed a sound investment is because it aids in building wealth. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter (see graph below):

So, before you decide to extend your rental agreement, it is important to consider the opportunity to build wealth that homeownership provides.

Final Thought

If you’re not sure whether to continue renting or to become a homeowner, let’s connect to help you make the best decision.